Metrovacesa closes the first quarter with an 81% increase in revenues and net profit of 10.7 million euros

- 141.1 million euros in revenues for the first three months of 2022 and a 19.5x increase in EBITDA to 15.6 million euros compared to the same period last year.

- The company’s significant improvement in operational and commercial terms has been reflected in a new record number of presales, 568 units (40% more than in the first quarter of 2021), and an 82% increase in deliveries compared to the same period last year, reaching 540 units.

- Metrovacesa’s differential profile as a strong cash generator allows it to close the first three months of 2022 with 46.9 million euros of operating cash, thus reinforcing its attractive shareholder remuneration potential for the current year.

- Confirms its annual targets for 2022: delivery of 1,600-2,000 homes and free cash flow generation of more than 150 million euros.

- “The first quarter figures confirm Metrovacesa’s remarkable operating performance, as has been evident in previous quarters. In an increasingly volatile and changing context, our Company is demonstrating its ability to respond to the needs of society and current demand, as a benchmark company in the Spanish real estate sector”, highlights Jorge Pérez de Leza, CEO of Metrovacesa.

Madrid, 04 May 2022. Metrovacesa, Spain’s leading real estate developer with more than 100 years of history, has closed the first quarter of the year with a significant improvement in its financial and operating results, enabling it to reconfirm its forecasts for the year as a whole.

In the first three months of the year, the company achieved revenues of 141.1 million euros (81% more than in the same period of the previous year), thanks to the delivery of 540 homes and the sale of land. It also boosted its EBITDA to €15.6 million (up from €0.8 million in the first quarter of 2021), in line with its ability to improve its profitability with the progressive increase in its activity. It also achieved a net profit of €10.7m (compared to a loss of €2.2m in the same quarter of the previous year).

The developer’s significant operating momentum during the first quarter of the year has enabled it to reinforce its unique cash generation profile, generating 46.9 million euros of operating cash as at 31 March. In this regard, Jorge Pérez de Leza, CEO of the company, highlighted that “Metrovacesa’s strength and investment attractiveness are reflected in the distribution, approved yesterday by the company’s General Shareholders’ Meeting, of a new dividend of 0.6 euros per share. This, together with the dividend paid out in December last year, represents a total amount of 151 million euros distributed out of the cash generated in 2021, which translates into one of the highest returns for shareholders on the Spanish Stock Exchange, of around 13%”.

It should be noted that Metrovacesa’s business is also supported by a very solid financial situation. The company’s net debt at 31 March 2022 stood at 126.8 million euros, compared to 162.1 million euros at the end of 2021. The company’s leverage ratio stood at 4.9% (vs. 6.2% at the end of 2021), remaining the lowest among listed developers in Spain. In addition, Axesor has upgraded by one notch the rating of the bond issued last year, with a ‘BBB’ rating.

Excellent operating performance that guarantees future cash flows.

During the first three months of 2022, Metrovacesa has registered a new quarterly record in terms of pre-sales, with a total of 568 homes, which translates into a 40% increase over the figure for the same period of the previous year, and with a good performance in the different markets in which the developer operates. As a result, the company’s cumulative pre-sales book for the last 12 months totalled 2,253 units, in line with the medium-term objectives.

On the other hand, confirming the strength of demand for housing and the current dynamism of development activity, from January to March 2022, the company handed over the keys to 540 homes, an increase of 82% compared to the first quarter of 2021. In the last 12 months, it has delivered a total of 1,871 homes, thus supporting the targets set for the current financial year. Specifically, Metrovacesa plans to deliver between 1,600 and 2,000 units, 85% of which are already pre-sold, with an average progress rate of 94% in construction work.

The company, in line with its objective of boosting the new-build housing market in Spain, has boosted the current offer with the launch of new projects in the different regions in which it operates. In this regard, it began marketing 986 homes in the first quarter, thus exceeding 6,000 units in its total portfolio of homes for sale, of which more than half were already pre-sold at 31 March. In terms of construction work, work began on 257 units during the first quarter of the year, bringing the total number of homes currently under construction for the developer to 3,724, which already includes 100% of the deliveries scheduled for 2023.

The economic recovery has also had a positive impact on the developer’s land sales, a business in which demand remains solid, especially for residential land. In this regard, Metrovacesa signed sales of 12.6 million euros in the first three months of the year and has positive expectations for the current year, as well as for the development of projects in the tertiary segment, in which it notes the improvement in activity and a clear interest from investors.

New General Sustainability Strategy 2022-2024 (ESG24)

Metrovacesa has updated its General Sustainability Strategy, leveraging on the significant progress achieved by the company in the 2020-2022 Sustainability Plan. This new approach defines an ambitious common action framework aligned with the developer’s activity and which focuses its objective on the development of a responsible and sustainable business model, with the aim of positioning the company at the forefront of the real estate development sector in terms of Sustainability and reaching the Top 10 best companies in the world in terms of ESG in its sector.

Metrovacesa’s ESG24 consists of 9 strategic lines and 21 lines of action articulated in the three ESG dimensions (Environmental, Social and Governance), which are materialised through 88 specific actions with monitoring indicators (KPIs) and an estimated budget. Likewise, the lines developed in the Strategy will contribute to the promotion and monitoring of the United Nations Sustainable Development Goals (SDGs).

Related articles

Descubre promociones que te pueden interesar

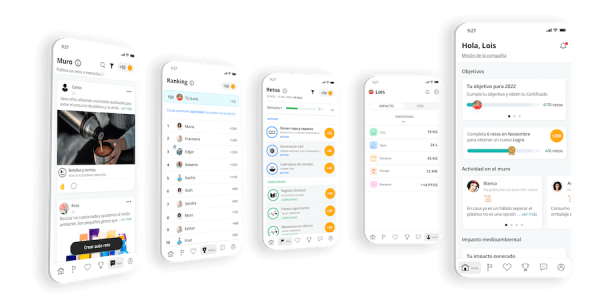

Discover your new home with MiA

We have launched our virtual agent to help you find the property you are looking for.

Ask MiA and get personalized recommendations to find your dream home. Try it now!